The digital asset landscape is bleeding red today as a catastrophic Bitcoin collapse sends shockwaves through global finance. In a staggering movement, Bitcoin has crashed over 13% in less than 24 hours, effectively erasing all value accrued since the presidential election 15 months ago. Traders and institutional investors are scrambling as the sell-off intensifies, driven by a toxic combination of massive leverage unwinding and a sudden flare-up in what analysts are calling a ‘crypto-geopolitics clash.’

Panic has set in across the board, affecting not just the market leader but the entire altcoin ecosystem. The sudden downturn has caught many off guard, particularly after a period of relative stability. As liquidation cascades trigger further price drops, the question on everyone’s mind is how deep this correction will go. For real-time updates on how this impacts broader financial sectors, keep an eye on the global markets.

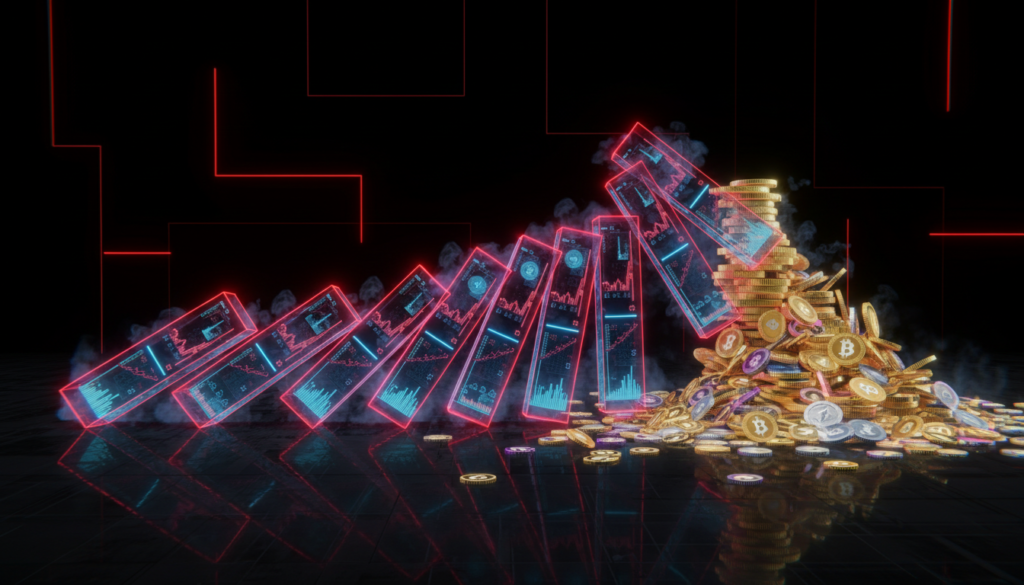

The Anatomy of the Bitcoin Collapse

This specific Bitcoin collapse is not merely a technical correction; it is a structural failure of over-leveraged positions. Billions of dollars in long positions were liquidated in hours, creating a domino effect that pushed prices down vertically. When traders borrow heavily to bet on price increases, a slight dip can force automatic sales, which drives the price down further, triggering more sales. This feedback loop is the primary engine behind today’s 13% plunge.

Market data suggests that leverage ratios had reached unsustainable highs leading up to this week. The flush-out was inevitable, but the trigger was unexpected. Regulatory concerns and shifting global alliances have spooked the whales. Investors looking for safety are retreating, impacting volume across investing platforms.

Crypto-Geopolitics Clash

The phrase “crypto-geopolitics clash” has emerged as the defining narrative of this crash. Tensions between major economic powers regarding the regulation of cross-border digital payments have escalated. New sanctions involving digital wallets and restrictions on mining hardware exports have created uncertainty. This friction disrupts the borderless promise of cryptocurrency, causing institutional capital to flee.

We are seeing similar supply chain tensions affecting hardware sectors, as noted in recent reports on India-US supply chain security. The correlation between geopolitical instability and crypto volatility is tightening, making digital assets less of a safe haven and more of a risk barometer.

Economic Pressures and Fed Policy

The macroeconomic backdrop has offered no safety net for the Bitcoin collapse. With the Federal Reserve’s interest rate strategy remaining hawkish to combat lingering price pressures, risk assets are suffering. Higher rates usually strengthen the dollar, which inversely pressures Bitcoin.

Recent data showing a rise in December inflation has dampened hopes for a rate cut anytime soon. This monetary tightness reduces the liquidity available for speculative assets. Investors are rotating out of high-risk crypto holdings and into yield-bearing traditional assets, exacerbating the sell-off. The broader economy is showing signs of strain, and crypto is the first to fracture under the weight.

Contrast with the Tech Sector

While the Bitcoin collapse dominates headlines, the technology sector is telling a slightly different story. High-growth tech stocks, particularly those involved in artificial intelligence, have shown resilience compared to the crypto carnage. For instance, the recent Nvidia AI market rally highlights a divergence where investors prefer tangible corporate earnings over speculative digital stores of value.

However, the contagion risk remains. A significant loss of wealth in the crypto sector often bleeds into tech stocks as investors sell winners to cover margin calls on their losers. Monitor the tech sector news closely for signs of this bleed-over. The stock market today is already showing volatility as traders digest the implications of the crypto crash.

Expert Analysis and Future Outlook

Financial experts from Bloomberg warn that the “buy the dip” mentality might be dangerous in this environment. The erasure of 15 months of gains indicates a complete reset of market sentiment. Without a clear catalyst for recovery, the downward pressure may persist.

Regulatory bodies are also watching closely. The SEC has long warned about the dangers of excessive leverage in unregulated markets. This crash may accelerate calls for stricter oversight, which could dampen price action in the short term but provide stability long term.

Meanwhile, international finance monitors like Reuters are tracking the flow of funds, noting a sharp movement of capital back into fiat currencies and sovereign bonds.

What This Means for Retail Investors

For the average holder, this Bitcoin collapse is a painful reminder of volatility. Strategies that worked during the post-election bull run are now failing. It is vital to assess risk tolerance and avoid emotional decision-making. Diversification remains the primary defense against such sector-specific implosions.

Key Takeaways

- Total Reversal: Bitcoin has lost all gains made since the November 2024 election.

- Leverage Flush: Over-leveraged long positions were liquidated, accelerating the crash.

- Geopolitical Trigger: A clash over digital asset regulation among global powers sparked the panic.

- Macro Headwinds: High interest rates and stubborn inflation are reducing appetite for risk.

- Divergence: While crypto tanks, AI-focused tech stocks are currently displaying more stability.

Final Thoughts

The Bitcoin collapse of February 2026 serves as a stark reality check for the digital asset market. The convergence of algorithmic liquidation and geopolitical strife has created a perfect storm. Whether this represents a generational buying opportunity or the beginning of a prolonged crypto winter depends heavily on how the regulatory and economic landscape evolves in the coming weeks.