Tax Season 2026: Your Complete Filing Guide for the 2025 Tax Year

As the calendar turns to 2026, millions of Americans are gearing up for a pivotal tax filing season. Tax Season 2026, covering the 2025 tax year, represents a significant moment in personal finance. Not only does it introduce new inflation-adjusted brackets and higher standard deductions, but it also marks the final full tax year before the scheduled expiration of many individual income tax provisions from the Tax Cuts and Jobs Act (TCJA) of 2017. Navigating this season with precision is essential for maximizing refunds and minimizing liabilities.

This guide provides a professional, objective overview of what to expect, from critical deadlines to the specific numbers defining your tax liability. Whether you are a single filer, a head of household, or managing complex investments, understanding these changes is the first step toward a successful filing.

Key Dates and Deadlines for Tax Season 2026

For most taxpayers, the focal point of Tax Season 2026 is the standard filing deadline. Unlike years where weekends or holidays push the date, this season follows the traditional schedule.

The April 15 Deadline

The deadline to file your 2025 federal income tax return or request an extension is Wednesday, April 15, 2026. Because this date falls on a mid-week business day and does not conflict with the Emancipation Day holiday in Washington, D.C. (which falls on April 16), taxpayers should not expect an automatic delay.

It is crucial to note that requesting an extension gives you until October 15, 2026, to file your paperwork, but it does not extend the time to pay any taxes owed. Payments must be estimated and submitted by the April deadline to avoid penalties and interest.

Updated Tax Brackets and Standard Deductions for 2025

The IRS has adjusted tax provisions for inflation to prevent “bracket creep,” where rising wages push earners into higher tax brackets without an increase in real purchasing power. These adjustments for the 2025 tax year (filed in 2026) are substantial.

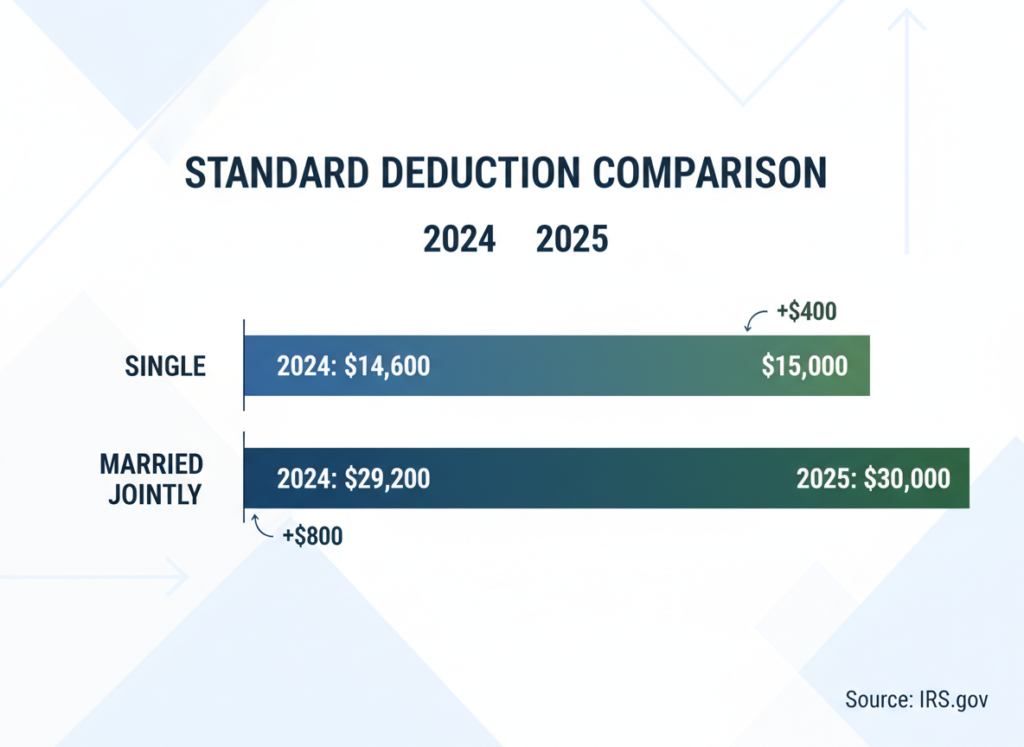

2025 Standard Deduction Amounts

For many taxpayers, the standard deduction remains the most efficient way to lower taxable income. The inflation-adjusted amounts for the 2025 tax year are as follows:

- Single and Married Filing Separately: $15,000 (up from $14,600 in 2024)

- Married Filing Jointly: $30,000 (up from $29,200 in 2024)

- Head of Household: $22,500 (up from $21,900 in 2024)

These increases mean that a married couple filing jointly can earn up to $30,000 before a single dollar is subject to federal income tax, simplifying the filing process for millions who choose not to itemize.

2025 Marginal Tax Rates

The marginal tax rates remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37%, but the income thresholds for each bracket have shifted upward. For example, the top rate of 37% now applies to:

- Single Filers: Income greater than $626,350

- Married Filing Jointly: Income greater than $751,600

For a detailed breakdown of all inflation adjustments, you can review the official IRS Revenue Procedure 2024-40, which outlines these changes in full.

The Looming Expiration of the Tax Cuts and Jobs Act (TCJA)

Tax Season 2026 carries extra weight as it involves the filing of the 2025 tax year return—the final year before the scheduled sunset of the TCJA’s individual provisions. Unless Congress acts to extend them, significant changes will occur starting January 1, 2026, impacting returns filed in 2027.

What Could Change After This Season?

Currently, the TCJA lowered individual income tax rates, nearly doubled the standard deduction, and increased the Child Tax Credit. If these provisions expire as scheduled at the end of 2025:

- Individual income tax rates would revert to pre-2018 levels (e.g., the top rate would rise from 37% to 39.6%).

- The standard deduction would be roughly halved, likely forcing many more taxpayers to itemize deductions again.

- The Child Tax Credit would revert to $1,000 per child, down from the current $2,000.

Financial experts advise using Tax Season 2026 as a strategic planning period. This is the time to maximize Roth conversions or harvest capital gains under the current favorable rates. For in-depth analysis on these expiring provisions, the Tax Foundation offers extensive data and projections.

Retirement Contribution Limits

Maximizing contributions to tax-advantaged accounts remains one of the most effective strategies to reduce tax liability. For the 2025 tax year (reported on your 2026 return), the limits are:

- 401(k), 403(b), and 457 plans: $23,500 (plus a $7,500 catch-up contribution for those age 50 and older).

- IRAs (Roth and Traditional): $7,000 (plus a $1,000 catch-up contribution for those age 50 and older).

Looking ahead to the 2026 calendar year (for planning purposes), these limits are projected to increase further due to inflation, potentially allowing savers to shield even more income. Reliable investment news sources like CNBC Personal Finance regularly update these projections as official cost-of-living data becomes available.

Strategic Moves for Tax Season 2026

1. Review Your Withholding Early

With the bracket adjustments, your current paycheck withholding might not align with your actual liability. Using the IRS Tax Withholding Estimator early in 2026 can help you adjust your W-4 to avoid a surprise bill or an excessively large refund that acts as an interest-free loan to the government.

2. Organize Gig Economy Documents

The IRS has delayed the implementation of the $600 reporting threshold for Form 1099-K in previous years, but for the 2025 tax year, reporting requirements for third-party payment platforms (like Venmo, PayPal, and gig apps) remain a critical area of focus. Ensure you have accurate records of all digital transactions to distinguish between taxable income and non-taxable personal reimbursements.

3. Consider “Bunching” Deductions

With the standard deduction at $30,000 for married couples, itemizing is less common. However, if you are on the cusp, “bunching” charitable contributions or medical expenses into the 2025 tax year can help you exceed the standard deduction threshold, maximizing your tax benefit before the potential law changes in 2026.

Tax Season 2026 is more than just a routine annual obligation; it is a strategic window closing on a specific era of tax policy. By understanding the new $15,000/$30,000 standard deductions, adhering to the April 15 deadline, and planning for the sunset of the TCJA, taxpayers can navigate this season with confidence. As always, consulting with a certified public accountant (CPA) or tax professional is recommended to tailor these general guidelines to your specific financial situation.