Surpasses Analyst Estimates with Strong Revenue and …

-

he won: $916 million was reported, exceeding the estimated $906.16 million.

-

net income: It grossed $66 million, exceeding expectations of $62.31 million.

-

Earnings per share (EPS): It was recorded at $0.92, surpassing the estimated price of $0.86.

-

Adjusted EBITDA: $191 million was reported for the quarter.

-

Dividend: A dividend of $0.50 per share was paid, with plans to recommend the same for the next quarter.

-

Share buyback: Repurchased 0.6 million shares for $25 million at an average price of $40.07 per share.

-

Financial flow: Net cash generated from operating activities was $47 million, significantly higher than $7 million in the previous year.

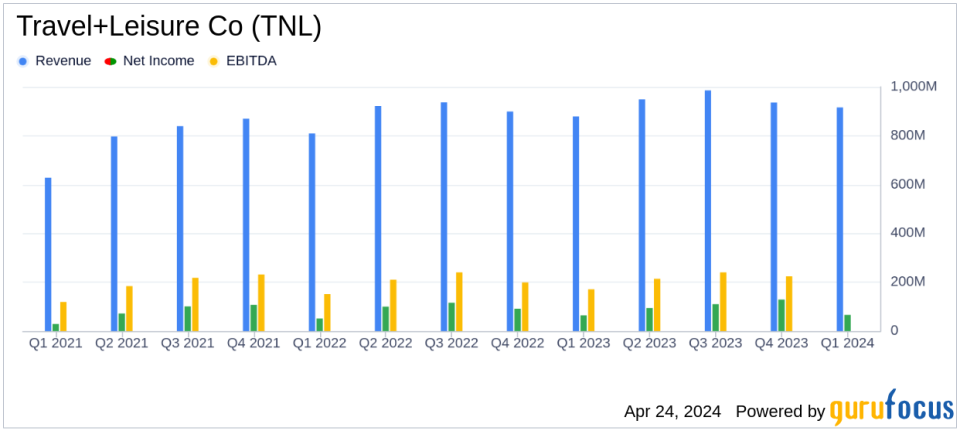

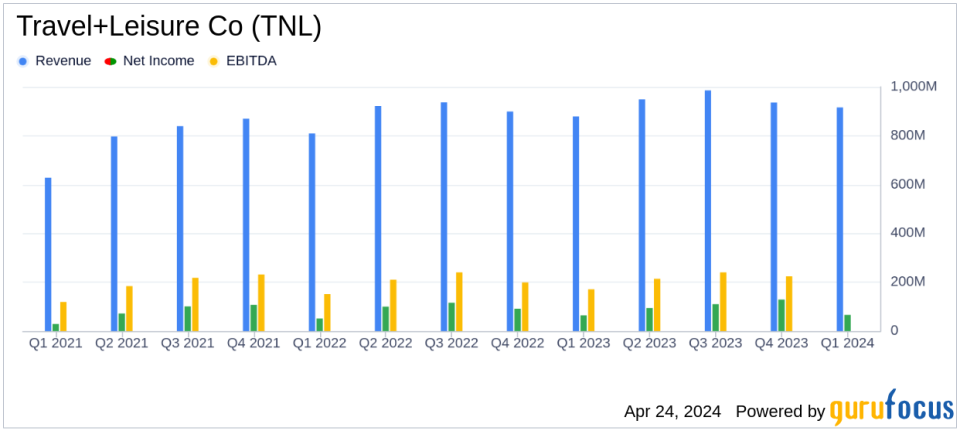

On April 24, 2024, Travel + Leisure (New York Stock Exchange: TNL), a global leader in membership and leisure travel, announced its financial results for the first quarter ending March 31, 2024. The company reported net income of $66 million and diluted earnings per share (EPS) of $0.92, on net revenues of $916. $1 million, beating analysts’ expectations of $0.86 earnings per share and $906.16 million in revenue. A detailed earnings report is available on the company’s website 8-K filing.

Company overview

Travel+Leisure Co. operates primarily through two segments: Vacation Ownership and Travel and Membership. The vacation ownership segment, a key revenue driver, saw revenue increase 6% to $725 million in the first quarter of 2024 compared to the same period last year. This segment focuses on developing, marketing and selling vacation ownership interests (VOIs) and providing consumer financing and property management services at resorts. However, the Travel and Membership segment saw a slight revenue decline of 4% to $193 million, due to lower transactions despite a marginal increase in revenue per transaction.

Financial performance and market challenges

The company’s strong performance in the vacation ownership segment was highlighted by a 9% increase in VOI net sales to $369 million. This growth was supported by an impressive 15% increase in rounds and 28% growth in new owner rounds. Despite these gains, the segment faced challenges such as a 6% decline in volume per guest (VPG) due to a higher mix of new owner tours, which typically results in lower VPG counts. Adjusted EBITDA for the segment increased 3% to $135 million.

On the liquidity front, Travel+Leisure reported a strong position with $479 million in cash and equivalents and total liquidity of $1.2 billion as of March 31, 2024. The company’s leverage ratio was 3.5x, while maintaining a stable financial structure.

Strategic initiatives and forecasts

President and CEO Michael D. Brown expressed confidence in the company’s strategic direction, highlighting the growth in tours and volume per guest. He noted the company’s readiness for a strong summer travel season and reiterated full-year adjusted EBITDA guidance of $910 million to $930 million. The company also plans to continue its shareholder return programs, with $25 million spent on stock buybacks and a fixed quarterly dividend of $0.50 per share.

Investment and future growth

Travel+Leisure Co.’s commitment to enhancing shareholder value and its strategic initiatives to capitalize on the growing travel and leisure market position it well for future growth. The company’s performance during this quarter reflects its effective management and operational efficiency, making it of interest to investors interested in the travel and entertainment sector.

For detailed financial tables and more information about the company’s performance, readers are advised to view the full earnings release.

Conclusion

Travel+Leisure Co.’s first-quarter results show a strong start to 2024, with performance metrics exceeding analyst expectations and strategic initiatives set to drive future growth. The Company’s strong financial health and proactive management strategies provide a strong foundation for continued success in the competitive travel and leisure industry.

Explore the full version of 8K Profits (here) from Travel+Leisure for more details.

This article first appeared on Gorovox.